If your visibility into cash balances is even a day old, you’re already flying blind. Seasonal swings, high fixed costs, and last-minute changes in occupancy mean money moves faster (and riskier) than in almost any other industry.

While profitability is crucial for long-term success, it’s liquidity that keeps the lights on and operations running smoothly day-to-day. Real-time cash visibility is what separates hotels that react to crises from those that stay a step ahead.

In this article, we’ll look at why cash visibility is so critical, the risks when it’s missing, and how better technology can close the gap.

The Risks of Limited Cash Visibility

If there’s anything the past five years have taught us, it’s just how strenuous unforeseen changes can be on finances. A global pandemic. Labor shortages. Inflation. Each one on its own is a problem. But together? They’ve created a unique storm that hoteliers are trying to find a way to navigate.

Across the board, finance teams are working hard to wrangle their finances and get a clearer (and more timely) picture of how these changing pressures are really hitting cash flow. They know that if they don’t, they risk operational blind spots, like:

- Expenses creeping ahead of revenue while reconciliations catch up weeks later.

- Receivable delays stacking up without you seeing the shortfall in time to reduce expenses.

- Capex draining reserves before debt or payroll obligations hit.

On top of that, they know that they also risk missing out on strategic opportunities and decisions. Having real-time visibility into cash balances helps hoteliers be in a better position to:

- Negotiate with lenders or suppliers from a position of strength.

- Time investments in renovations or new markets.

- Shift spend dynamically between properties to cover shortfalls.

- Allocate resources to seize growth opportunities while others are stuck in reaction mode.

Without that real-time clarity, you’re left delaying instead of leading. And that can be an expensive way to operate.

Why Do Hotels Still Struggle With Cash Visibility?

Despite knowing the risks associated with limited visibility, many finance teams can’t get ahead because of the manual steps required. Often their accounting systems were never designed to give them real-time cash visibility and still require teams to:

- Log in to multiple bank portals individually every morning just to pull balances.

- Export files, upload them into the accounting system, and wait on manual reconciliations.

- Rely on separate reconciliation software that only works after the data is uploaded.

This results in them spending hours chasing yesterday’s numbers instead of making today’s decisions.

Those hurdles are frustrating, but the deeper issue is what they obscure.

If your teams had access to:

- Live bank feeds showing balances and transactions in real time

- A single place to sign on to all bank accounts

- Automated reconciliation that smart-matches deposits, withdrawals, and recurring transactions on their accounting platform

…then cash management wouldn’t be a guessing game. It would be clear, immediate, and actionable.

HIA Is Closing That Gap

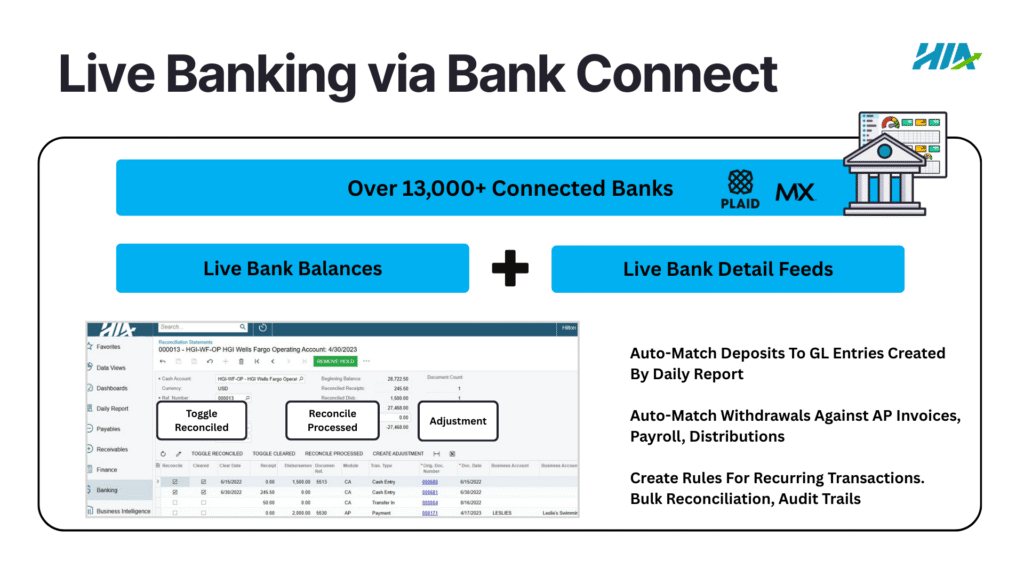

While most accounting platforms in hospitality stop short of true real-time banking integration, HIA’s Bank Connect tool was designed to close that gap. It’s designed to bring every account (operating, payroll, credit cards, reserves) into one secure dashboard and keep balances up to the minute.

What sets Bank Connect apart are features like:

- Over 13,000 single sign-on bank connections for real-time monitoring

- Easy one-time setup to connect any account and schedule syncs

- Secure API connection via MX and Plaid with AES/TLS encryption

- A single dashboard to view all hotel and portfolio cash positions in one place

- Automated bank reconciliation with Smart-Match technology (including rules for recurring transactions and full audit trails)

- Mobile app access (Apple + Android)

The Benefits for Hotel Finance Teams

With these banking tools in place, hotel finance leaders see immediate benefits:

- Time back in your day: What used to take hours of logging into portals and wrangling spreadsheets now happens in minutes.

- Cleaner data, fewer mistakes: Direct integration with the GL means less room for manual errors or duplicate postings.

- Reconciliations that don’t pile up: Automated matching makes daily reconciliations realistic. That means month-end close isn’t a fire drill, and variances get spotted sooner.

- Security you don’t have to second-guess: Encrypted connections and role-based access keep sensitive financial data locked down.

- Clarity across the portfolio: One dashboard brings every account together so you can make smarter decisions with confidence.

And the results speak for themselves. As the CFO of Rainmaker Hospitality put it:

“We’ve been able to reduce the time spent on bank reconciliations by 50%. We now close our monthly books even faster than we ever thought possible.”

— Prakash Maggan, CFO, Rainmaker Hospitality

Bottom line: Cash flow in hospitality will always be under pressure. The difference is whether you have the tools to see it in real time and act on it. If your current accounting system isn’t offering effective tools like real-time visibility and automations for better cash management, it may be time to rethink the system you are on.

Reach out to one of our experts to learn more.

Jaime Goss has over a decade of marketing experience in the hospitality industry. At Hotel Investor Apps, Jaime heads up marketing initiatives including brand strategy, website design, content, email marketing, advertising and press relations.